Readers Write About Mac Office, $150 Million

Responding to Mac Office, $150 Million, and the Story Nobody Covered readers wrote about other troubling components of the 1997 deal, and how much Microsoft secretly paid Apple in addition to its simple investment.

Freedom of Speechlessness?

The deal struck between Apple and Microsoft wasn't just about agreeing to share patents and settle disputes. In addition to its attempts to negotiate the death of QuickTime, it appears Microsoft also leveraged its Office monopoly to gain the final word in other areas as well.

“Part of the deal included speech recognition,” writes Richard Smith of New Zealand. “Apple had to drop all research into speech recognition, and was only left with enough room to be allowed to update what it already had for the current OS. As a result, OS 9, through OS X 10.4 and, yes including 10.5 Leopard, the speech recognition technology has not changed in 10 years.

“Microsoft had their own speech recognition technology in the works at the time... where is it now?”

David Marcoot says, “I had read in years past (and i forget the source) that part of this deal with Microsoft, Apple agreed to not work on voice technologies for 5 years. Whether this is true or not, I can't say. But it is interesting that in the first major upgrade to OS X and Windows since the 5 years has past, that both systems offer vastly improved voices, with Apple's being clearly superior.”

Cat and Mouse Got Your Tongue?

Is it true that Apple was forced to abandon new research into speech technologies? Microsoft just delivered new speech recognition and voice technologies in Vista, nearly a full ten years after the 1997 agreement.

Apple's efforts in speech technology don't seem to have changed a lot since then. However, patent filings reported by Dennis Sellers indicate that Apple has been working in speech recognition.

Filed in 2001, and made public just a few months ago, the patent describes "speech recognition using latent semantic adaptation." It appears the research is related to learning patterns of words, so the recognizer engine can adapt to distinguish between the similar sounding phrases "recognize speech” and “wreck a nice beach," and determine the correct result based on the context.

Apple's PlainTalk

Around the development of QuickTime and PowerTalk in 1990, Apple invested significantly in speech recognition technologies, which were released with the Centris AV and Quadra AV models in 1993, just a year before the arrival PowerPC.

The AV Macs had a specialized digital signal processor to help the main 68040 processor with computationally difficult tasks, somewhat analogous to the PowerPC's later built-in Altivec and the SSE used by Intel Macs.

Apple's then new PlainTalk expanded upon the role of the simpler MacinTalk speech synthesis, which had existed since the Mac's original release, to handle both clearer speech synthesis--converting text to speech--and provide new speech recognition--responding to spoken commands.

Apple has never offered software designed for dictation; PlainTalk was only intended to allow voice control of the interface, and therefore is most useful to disabled users for whom voice command is a more practical option. Few improvements obvious to users have been made to improve upon recognition or synthesis since then.

Held Back or Not Ready?

While Leopard demonstrations include a major new jump in natural sounding voice synthesis, nothing has been publicly reported about new voice recognition features.

Apple describes speech recognition as an accessibility feature, not as a keyboard replacement. This is very likely because it simply isn't a very practical alternative to the keyboard and mouse for users who can use them.

Did the 1997 deal hold Apple back in releasing new voice features, or has it simply been a case of impractical technology? If you know, you should tell.

Speaking of sharing and 1997: who has a copy of the awful Gil Amelio presentation from the January Macworld Expo? It's not on YouTube.

If you've seen it elsewhere, or have some bootleg copy of Amelio’s infamous ramblings that helped impress upon the world the true depth of Apple's beleaguerment, please share the fun.

How Much Did Apple Get?

The original article noted several major settlements that a variety of companies got from Microsoft for similar antitrust and patent infringement cases. While Apple was known to have received additional payments beyond the $150 million investment, the amount was never publicly disclosed. How much did Apple get?

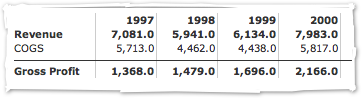

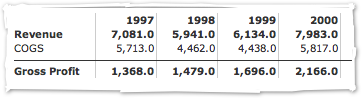

The article stated, “Apple's financial records suggest it was substantial. Despite losing $850 million the year before, over a billion dollars in 1997--of which around 600 million was related to buying NeXT, and suffering a billion dollar drop in revenues between 1997-1998, Apple mysteriously managed to maintain its investments and actually accumulated cash.”

Ian Hobson writes, “I really would have expected any large settlement like you're reporting to have been visible within the statutory accounts. A loss is a loss and a profit is a profit. Apple made losses in those years I think (or small profits). These were not just operating losses but full losses. A payment by Microsoft would have been a one-time exceptional gain which would have to show up in some profits numbers at some point, even if the actual source managed to get hidden.

“It is possible to have big losses and not lose cash. For instance, you might have a lot of inventory of machines which you have paid for and recorded as cost of goods sold, but which you end up having to sell cheaply. You can't do this for very long of course, but you can certainly do it for a while. Before the sales, the goods are shown on your balance sheet as an asset worth perhaps what you paid for them. When you sell them, the assets are reduced to zero, and cash is increased, but a loss will be recorded.

“Back then, Apple's manufacturing was far less efficient - I think they used to do it themselves. So they would have lots of work in progress inventory - RAM, hard disks, screens etc all sitting on balance sheet until they could sell the finished product at whatever price. Also R&D cost of those products would possibly have been capitalized on expectation of future sales.

“If such a problem had happened again, then you might have seen Apple's creditworthiness plunge; indeed I have recollections that it took in more cash in the form of loans at the time of the Microsoft deal, and that Microsoft's injection was indeed very helpful for its credit rating.”

Investigating Apple's Books

William Proctor did some investigation. He writes, “I reviewed Apple's 10K reports for 1997 and 1998 paying close attention to the consolidated notes to the financial statements and the cash flow statements. I am afraid your theory is probably not true.”

“First, Apple does not mention in its notes any other payments from Microsoft save the $150 million in preferred stock sold in 1997.

“Second, the cash flow statements for the two years show no sign of of ‘other’ cash inflows.

“The other part of your mystery was Apple losing almost two billion dollars over the course 1996 and 1997 yet maintaining its cash holding over that period. Again, the cash flow statement reveals while Apple was losing money on the income statement it were never running a negative operational cash flow during those years.

“Here is a direct quote from the 1998 10k regarding Apple's liquidity and capital resources:

“‘As of September 25, 1998, the Company had $2.3 billion in cash, cash equivalents, and short-term investments, an increase of $841 million or 58% over the same balances at the end of fiscal 1997. During fiscal 1998, the Company's primary source of cash was $775 million in cash flows from operating activities. Cash generated by operations was primarily from net income, declines in inventory and accounts receivable resulting from improved asset management, and by a decline in other  assets.’

assets.’

assets.’

assets.’“My take on this returns to your thoughts on Mac profitability. Even during the dark years of 1996-1998 the Mac generated enough profit margin to keep the company afloat.”

Losing Money While Earning Profits

So despite losing money due to poor operations, including those piles of unsold Perfomas and the cruel irony of a billion in backlogged orders that couldn't be delivered on time, Apple was making regular and significant profits on its hardware sales.

In other words, we can’t blame Apple’s survival on vast sums pulled from the clutches of Microsoft after all. It appears Apple simply stopped its losses, reformed its business, continued developing new products, and built new business.

Reversals of Fortune

It's interesting to compare the mid-90's Apple with todays' Microsoft. Apple was bringing in large revenues from its hardware operations, but frittering its gross profits away in operational losses.

Microsoft is bringing in substantial profits from its software licensing in Windows, Office, and server operations, but has been unable to earn any profits from any of its consumer electronics operations, and still manages to burn through many billions in operational expenses.

Microsoft in 2007 has a shakier outlook than Apple did in 1997, and the Windows Mobile Killer isn’t even out yet.

Like reading RoughlyDrafted? Share articles with your friends, link from your blog, and subscribe to my podcast!

Did I miss any details?

Next Articles:

This Series

|

|

|

|

Del.icio.us |

Del.icio.us |

Technorati |

About RDM |

Forum : Feed |

Technorati |

About RDM |

Forum : Feed |

Monday, March 19, 2007

Send Link

Send Link Reddit

Reddit Slashdot

Slashdot NewsTrust

NewsTrust