The Secret Failures of Microsoft

Why Microsoft Can’t Compete With iTunes examined Microsoft’s past success in software development, and demonstrated why its past practices won’t be of any help in expanding into the consumer electronics and digital media download business.

While the mainstream media is conspicuously quiet on Microsoft’s track record in consumer electronics, I’m more than willing to share!

Considering how many industry giants have partnered with Microsoft in WMA and PlaysForSure--including WalMart, Napster, MTV, WMA hardware makers, and RIAA label members--it would appear that Microsoft is a leader in successful consumer electronics technology. That’s not the case.

All of these partners hooked up with Microsoft simply because they had no idea of what to do on their own. Few even experimented with their own independent technology plans; they simply picked Microsoft because the company seemed like a safe bet at delivering technology. They obviously didn’t do their homework.

The big secret they missed is that Microsoft hasn't ever earned significant profits in the consumer hardware business, nor has its executives proven any business acumen in delivering what consumers want in hardware or creative entertainment, excluding, of course, Microsoft's impressive and highly sophisticated keyboard and mouse division.

The Problem of Choice

In fact, Microsoft only earns a tiny fraction of its revenues from sales to consumers; the majority of its revenues do not result from buyers choosing a Microsoft product, but from corporations and individuals buying a PC and being instantly bound in a End User License Agreement.

There is no choice involved; even most Linux users are forced to pay for a Microsoft license in order to obtain a brand name PC.

Interestingly, when I pointed out how this gives Microsoft half of the credit for all PCs sold in Market Share Myth: Nailed!, PC enthusiasts went berserk and tried to invent logic to prove otherwise. Ian Betteridge stuck around for two weeks posting comments that insisted a Windows license was no more important than a video card or a bundled game or utility.

But that isn't true; there are multiple sources for video cards and trivial bundled software, but only one source for commercial PC operating systems: Microsoft. PC makers have no choice in competing operating systems, nor can they sell PCs without an operating system, as I presented in the previous article.

They are bound to an oath to swear allegiance to Windows XP Professional, and must never mention Linux and Windows in the same breath. If they step out of line in any way, Microsoft dramatically raises their OEM licensing fees and sends them to indoctrination camp, where they face chairs being hurled at them by angry monkeys.

An Unpleasant Secret

Why do Windows enthusiasts exibit much hostility to an obvious fact? Because if they admit that 80% of the company's revenues come entirely from an OEM tax, and not from any choice on the part of consumers, they also have to admit that Apple's share of the market--which is based entirely on consumers going out of their way to make a choice--is not only underestimated, but a potential disaster looming for Microsoft.

They have to admit that as soon as customers are presented with the freedom of a real choice, they are not likely to choose Microsoft's products over those from rivals.

That's a scary proposition for Microsoft's shareholders and others invested in the company because, outside of automatic OEM sales of PC licenses, all Microsoft has delivered in the consumer electronics industry is a long string of failures:

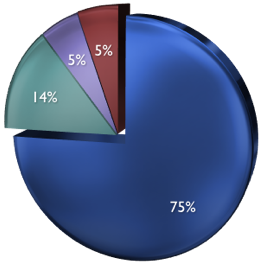

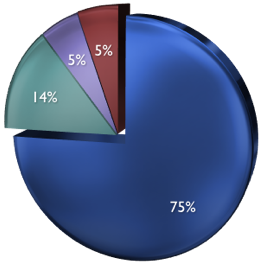

Phones & PDAs. Microsoft's decade of investments in WinCE and Windows Mobile Smartphones have only barely matched the market share of Palm, which itself is a run down company out of ideas. Microsoft couldn't out-maneuver the incompetent Palm within a decade of trying; now both are ineffectually fighting over the dying PDA industry while Linux and Symbian slaughter them in the smartphone arena:

Symbian 75%; Linux 14%; Microsoft 5%; Palm 5%.

Tablets, Handheld PCs & Origami. While the smoke rises from WinCE's ashes, Microsoft's efforts to sell its full desktop version of Windows on alternative form factor PCs has similarly fizzled. Microsoft admits that its Tablet PCs and so called "ultramobile" devices are not selling and are not at all interesting to consumers. Clunky!

WebTV, Ultimate TV, and MSN TV were all related attempts to find new markets for the regular PC by hiding it in a television. As it turns out, not only have competitors such as Tivo delivered better products without using a PC, but the DVR market is an unprofitable, highly competitive industry anyway.

Xbox game console. Microsoft's biggest success involved an unusual departure from its software licensing strategy. Microsoft sells the Xbox as an integrated hardware and software system, just like Apple's Mac and iPod. Microsoft has sold fewer than half as many Xbox units (24 million) in the the last five years as Apple has sold iPods (60 million), but Microsoft hasn't been making a profit; they've lost billions! That's a "success" most companies can't afford to experience.

As Microsoft's string of consumer failures point out, the company does not do well when positioned in a market where real competition exists and its software monopoly offers it little or no advantage over rivals.

Burning Ring of Fire

WMA and PlaysForSure specifically failed because the separation of stores, players and technology did not add value for consumers; all it did was create confusion. With Zune, Microsoft is abandoning its PlaysForSure music store and hardware partners in order to deliver an integrated product more similar to Apple's iPod.

But the Zune is too little, too late. Microsoft will repeat its WMA failure with Zune, not because it’s wrong to try shipping an integrated product, but because the Zune lacks of any real connection to the Windows monopoly.

Without any way to tie the new product into its existing, competition-free Windows environment, Microsoft is powerless to force its adoption. Microsoft will be exposed to live competition in real market, which the company has only rarely experienced in the last decade.

The company is in trouble because its core competency is in marketing vaporware using FUD: creating a product illusion that fools enough people to repress sales of existing products, paving the way for the introduction of a ‘nothing special’ product which dominates simply because there’s no competition left to challenge it.

However, the Creative Zen, SanDisk Sansa, and Apple iPod are already established products with satisfied users. FUD isn’t going to work, primarily because the IT cult priesthood is powerless to push Microsoft’s consumer electronics the way it pushed the Windows PC.

An Ugly Battle

Microsoft is in the position of a pro wrestler who has only fought for show in staged fights, but has now been thrown into a no holds barred street fight against assassins with nothing on their minds but survival.

In this fight, Microsoft will not get to choose who to fight against; it will be pitted against a variety of sly characters all fighting over the same alley, and all at the same time.

Microsoft seems to think it is challenging Apple to a gentleman's duel. It tries to spin Zune as a direct competitor to the iPod and somehow entirely independent from its PlaysForSure strategy in a magical way that will allow the Zune and other PlaysForSure devices to coexist in friendly harmony. That's simply not the case.

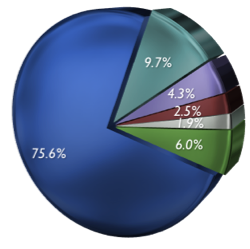

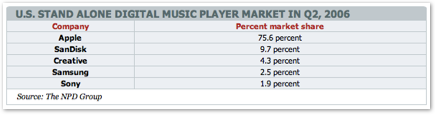

Everyone who wants a piece of the music player market, including existing PlaysForSure makers, will have to fight against Microsoft. The Zune will quite obviously appeal to customers who don't want an iPod. That segment of the market, which has held consistently at 25% for several years now, is already enflamed with serious competition.

In order to begin to compete against the iPod, Microsoft will have to fight its way past Sony, Samsung, Creative and the second place SanDisk, and it will only get that far by first cannibalizing sales of other PlaysForSure devices! Toshiba, the maker of the Gigabeat/Zune, currently claims so few sales that it’s not even on the chart.

Interestingly, SanDisk recently tripled its market share to 9.7%, but all of its growth came by eating up other WMA players; the Zune can only hope to do as well, but it lacks the Sansa’s differentiation.

Further, SanDisk is certainly not about to give back its gains without a fight; it also has the competitive advantage of being its own RAM manufacturer. Microsoft simply has no guns to pull out at all.

These fighters can also play dirty. Creative, having already collected a $100 million settlement from Apple over its Zen patent lawsuit, is now going after Microsoft. The only difference is that Microsoft hasn't made any money from the Zune yet, nor does it have a “Made for Zune” peace offering to hand Creative. Oh the Humanity!

Another Fierce Market

Paired with the history of failures in the consumer electronics space, what will save Microsoft's bacon? Some analysts seem to think that Microsoft has billions in the bank to throw away while leisurely chasing down the iPod.

But that's not true. That money belongs to shareholders, because Microsoft is owned by shareholders, just like every other publicly held company. Anyone who says Microsoft has lots of money to burn hasn't ever met angry shareholders.

Microsoft's shares are themselves competing in a free market: the stock market. If Microsoft doesn't continue to create new markets and find new revenues, its investors will pull out to invest in companies who can.

When that happens, Microsoft’s valuation will sag. There are plenty of companies with glorious pasts who suddenly lost their stock valuation after a series of badly executed strategies. The mid-90's Apple is a good example.

After two decades of brilliant success, Apple's valuation dropped into the toilet in the mid 90's when the company failed to deliver progress and demonstrated an inability to find new markets and new sources of revenue.

The tech industry is full of one-time leaders who fell down dead. Anyone who thinks Microsoft is immune to failure is simply choosing to not pay attention to reality.

Next: consider the lessons learned in the real world reversal of fortune between Microsoft and Apple from just over a decade ago, in Platform Death Match - 1990-1995: Apple vs. Microsoft in the Enterprise.

This Series

Wednesday, October 11, 2006

Bookmark on Del.icio.us

Bookmark on Del.icio.us Discuss on Reddit

Discuss on Reddit Critically review on NewsTrust

Critically review on NewsTrust Forward to Friends

Forward to Friends

Get RSS Feed

Get RSS Feed Download RSS Widget

Download RSS Widget