Did iTunes Kill the Record Store?

Record stores across America are turning up dead, including more than few established, high profile chains. Who killed the record store? Was it the iPod, iTunes Store, or is the real killer still on the loose?

The Fall of Tower Records

One of the chains forced to shut down its stores was the iconic Tower Records. The company entered bankruptcy protection in 2004. Creditors subsequently bailed the chain out, hoping that it could be salvaged.

The National Association of Recording Merchants had repeatedly named Tower "Retailer of the Year" over the last three years, but that didn't stop the collapse of America's eighth largest music store.

Tower was quickly liquidated this winter by Great American Group, whose bankruptcy bid won the remains of Tower's retail music stores; it quickly closed them all down, although stores outside the US and an online store are still being run independently under the Tower name.

Tower isn't the only music chain facing financial troubles.

-

•HMV closed all its US stores in 2004.

-

•Virgin Megastores reported losses of $495 million over the last two years.

Trans World Success?

The largest record store chain in the US is FYE. It's owned by Trans World Entertainment, which has been buying up troubled music store chains since 2003: Camelot, Wherehouse Entertainment, CD World, and most recently Musicland and its Sam Goody and Suncoast branded stores.

Trans World had also hoped to buy up Tower Records and keep some of its stores open. Despite continuing to expand its music store business however, Trans World reported slipping revenues over the last half decade.

One of the few music store chains actually doing well is Hastings, which has managed to increase its revenues in four of the last five years. However, Hastings' growth has largely come from books and videos rather than music sales, which currently only make up a quarter of its revenues.

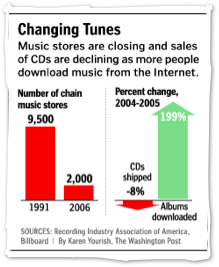

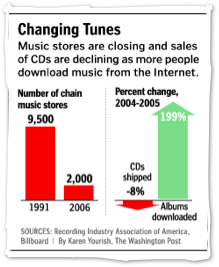

Who killed the record store? The death of chains since 2004 provides some circumstantial evidence that points to Apple’s iTunes Store. The Washington Post fingered online sales, specifically mentioning iTunes next to a chart showing CD sales down and online sales up dramatically.

Did iTunes and Apple's ubiquitous iPod conspire to kill the record store? Are the big record labels somehow to blame? Was it simply a mass suicide?

CD+DRM = Failure

Things change in the music industry. Over the last decade for example, music sales rapidly moved away from cassette tapes to CDs.

In 1996, the RIAA reported that tapes accounted for nearly 20% of sales. Today, tapes are hard to find, while CDs expanded from 68.4% in 1996 to 87% of all purchased music in 2005.

As the technology to rip CDs became commonplace, the labels hoped to move consumers from CDs to unrippable, DRM-encrypted discs, including DVD-Audio and SACD. Both formats offer higher definition sound quality than standard CDs, as well as support for 5.1 surround channel sound.

Consumers didn't buy them however; both formats combined only managed to make up 2% of the music market in 2005, after several years of rivaling each other in the bid to replace the CD. Their failure offers a lesson that Blu-Ray and HD-DVD backers might benefit from contemplating.

SACD was introduced by Sony and Phillips, the same companies that had earlier hamstrung the release of DAT with excessive DRM. DVD-Audio was pushed by the DVD Forum, a consortium that responded to the cracking of DVD’s CSS by introducing even tougher encryption for DVD-Audio. It has subsequently been cracked as well.

Online DRM Fails

The labels also hoped that Microsoft's Windows Media DRM would help to sell music online, but none of Microsoft's partner stores ever developed sales that amounted to anything. As CD sales began to grow stagnant and online piracy expanded, the labels finally agreed to sell music in Apple's iTunes Store.

In the years since, Apple has sold over two billion songs, and sales are rapidly increasing. Still, downloads only amount to 5-6% of the music sold over the last couple years, depending on who's counting.

That means Apple's iTunes Store--which sold the vast majority of those downloads--didn't have enough sales to kill the record stores, despite the graphic comparison of percentages of change printed by the Washington Post to suggest otherwise.

The huge percentages of growth really highlight that online music sales have rapidly expanded from nearly nothing just a year or two ago. Online sales were tiny in the 2003-2004 period when the record stores began their steady decline.

Today, web retailers--including Amazon--are together selling more music on CDs than Apple is selling in FairPlay downloads. Internet sales amounted to 8.2% of all music in all formats outside of digital downloads.

Even adding Apple's digital downloads to physical CD sales over the Internet to fails to add up to a killer blow to the music stores; the shift to web based sales has largely only served to replace the direct mail sales by formerly sold through record clubs.

The Internet didn’t kill music stores.

Trail of the Real Killer

A look at the range of retail CD prices helps to establish what really killed the record stores. In an article about the demise of Tower Records, Elaine Misonzhnik observed:

"Wal-Mart, Target and Virgin Megastores (through the Amazon.com website) have been selling the recently released Christina Aguilera CD Back to Basics for $11.88. But Tower Records was selling the same CD for $17.99; F.Y.E. for $14.99; and Amarillo, Texas-based Hastings Entertainment, Inc. for $15.39."

Ah-ha! Record stores were trying to turn a profit, and simply starved to death. Dramatically cheaper albums, sold by big box retailers, killed the business model of stores hoping to stay in business selling CDs at list prices.

How can Wal-Mart and Target afford to sell CDs for a third less than CD stores? Easy: the big box retailers aren't planning to make money on CDs, but rather offer CDs as loss leaders to generate foot traffic. Music stores were trampled to death under the feet of shoppers running to Wal-Mart.

Retail Bandwagon

Other retailers have also found that selling CDs helps to attract customers and then keep them in the store longer. Misonzhnik noted that Radio Shack, 7-Eleven, and JC Penney have all added CD sales in attempts to bring in more customers.

Even Starbucks began selling CDs to encourage customers to linger, although it sells exclusive CDs which don't directly compete with albums from record stores.

By selling popular CD titles at a loss, Wal-Mart, Target, and other retailers have traded the easy profits on CDs--which formerly kept music stores in business--into store advertising and then wrote it off as a business expense.

The Long Tail

The remaining business of record stores has been catalog sales: the long tail of titles that are not available in the limited selection of CDs offered at a deep discount by general big box retail stores.

However, many of the record store chains that are closing simply couldn't afford to stock a huge selection of less popular acts, and were instead trying to compete directly against companies with no need to profit from CD sales.

That strategy has pushed customers interested in a broader selection to online sales: CDs from Amazon's catalog and downloads from Apple's increasingly large collection of music.

Wal-Mart Takes on Downloads

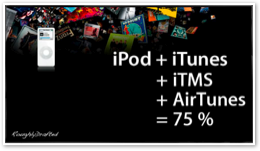

Having destroyed the music store, Wal-Mart has turned its market power to the Internet in hopes of dominating online sales as well. The company teamed up with Microsoft to sell online downloads, and underpriced Apples iTunes Store with 88 cent songs.

Efforts of the pair of monopolizing giants to take over online sales have been blocked by Apple's dominant position with the iPod. Microsoft's DRM doesn't work on the iPod, cutting Wal-Mart out of the market for the vast majority of potential buyers of online music.

By forcing third parties to sell their music without DRM in order to work on the iPod, Apple has pushed buyers toward CDs and MP3s stores, and choked sales from rival DRM outlets selling Microsoft PlaysForSure music.

Last year, download sales essentially doubled over the year prior across the board, from current albums in recent release to catalog sales and "deep catalog," the industry term for older and more obscure albums.

Sales growth in iTunes was actually stronger in catalog and deep catalog albums than in recent releases, underlining that the iTunes Store is picking up the broader, older album sales that dying record stores are leaving behind after being finished off in their attempts to compete in sales of recently released albums against the big box retail stores offering those same albums at cost.

Like reading RoughlyDrafted? Share articles with your friends, link from your blog, and subscribe to my podcast!

Did I miss any details?

Next Articles:

This Series

|

|

|

|

Del.icio.us |

Del.icio.us |

Technorati |

About RDM |

Forum : Feed |

Technorati |

About RDM |

Forum : Feed |

Friday, March 2, 2007

Send Link

Send Link Reddit

Reddit Slashdot

Slashdot NewsTrust

NewsTrust