Readers Write about the Battle for the Desktop

Responding to Can Apple Take Microsoft in the Battle for the Desktop? readers asked about Apple’s ability to compete for PC sales; the revenue, earnings and market share figures cited in the article; and Microsoft’s inevitable response to Apple’s competitive threat.

Comments from Slashdot

The article was posted on Slashdot, where there were around 500 comments. At the bottom of the comments is a reply by DJ entitled Everybody seems to be missing the point which observed:

Either most posters here have missed the point of the article, or didn't bother to read it.

He's not saying Apple will win larger market share than Microsoft. He's saying that Apple could capture the most valuable part of it, those willing to pay a high-end premium for their machines.

The premise of the article is that Dell and other PC makers would be left selling very, very low-profit computers. (which from a business stand-point, is not a good business to be in)

This has nothing to do with game computers or those willing to build their own boxes. It's a business story.

Competing with Microsoft = DELL OS X?

Another comment raised the perennial complaint: Apple does not compete directly with Microsoft and won't do until they release an OS that run on industry-standard x86-boxes instead of just Apple-proprietary x86-boxes.

Reader LKM answered: The article's main point is that Apple competes with the likes of Dell and Lenovo, and is in a very good situation since it can offer a fully integrated solution.

That actually also answers the second part of your post: Since Apple's competitive advantage is that they make "the whole widget" (as Jobs likes to call it), selling an unbundled retail version of OS X for "generic" PCs kinda destroys that advantage.

Not to mention that this strategy has never been successful: It didn't work for NeXT, IBM, or Be, and in fact, it didn't even work for Microsoft. People don't buy Vista, they get Vista when they buy a new Computer.

Add to that the fact that “industry standard” PCs from Dell and HP are no less “proprietary” than Apple’s Macs.

The Single Vendor Enterprise Myth

Reader RB: Apple's market share has remained self-capping for twenty years because the company has misguidedly insisted that its software be usable only on Apple's wholly proprietary, single-vendor hardware. No corporate I.T. manager will risk being unable to quickly provision a new department with 20, 200, or more computers simply because a single hardware manufacturer is unable to quickly ship the necessary hardware.

Proprietary strikes again! The real question however, is: do IT managers buy their PCs from Best Buy, or do they instead maintain relationships with PC maker’s corporate sales? Hint: oh wait, you don’t need a hint.

Most companies have standardized on one hardware vendor for both support and pricing advantages, so being tied to Apple is no different than being tied to Dell. A company standardizing on Dell does not rush out to buy HPs or store brand PCs from Costco in a pinch, nor would they want to support that as an option.

There are large information technology groups that have standardized on Apple hardware, particularly in education--even entire universities:

“Macs are constructed with superior technology and hardware and their ability to run Windows means we still have access to any Windows programs. We’re making working and learning more efficient. It’s the best of both worlds” - Scott Byers, vice president for finance and general counsel at Wilkes University.

Macs were purged out of business starting in the mid 90s, after Apple proved itself to be unmanaged and incompetent. Before then, it was common to find medium sized businesses that had standardized on Macs.

Today there are far more significant reasons to go Mac than there ever was. Macs are Unix workstations running on industry standard hardware. There are entire industries that demand Unix workstations that can run desktop applications, and Windows doesn't cut it. Those same industries are also flush with cash and already like Apple: biotech, film and video production, and academic research.

Why do Windows enthusiasts think that low value PCs sitting in worker cubicles running a terminal emulator is where the money is in Enterprise sales? Absurd!

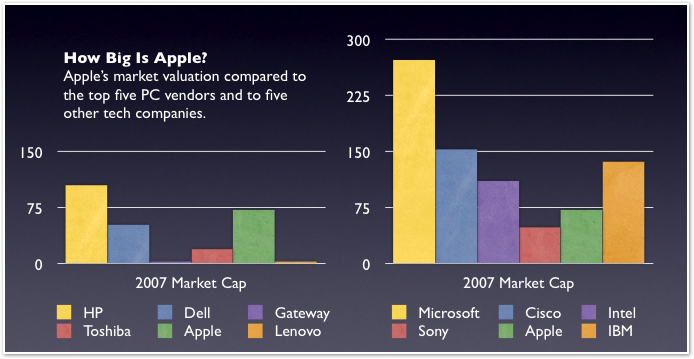

The Charts and Numbers

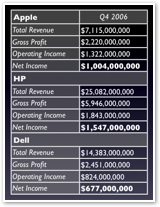

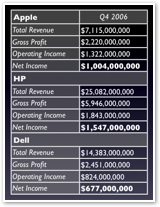

The article presented revenue and income comparisons for HP, Dell and Apple, and the market capitalization of a variety of tech companies. It didn't provide much explanation of what the numbers mean however.

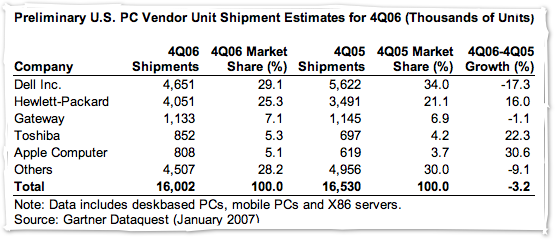

GM: Are the market share and revenue numbers only desktop and notebook PC sales for [HP, Dell, and Apple]? Because they sell other stuff as well, from iPods (Apple), to servers (Dell) and supercomputers (HP).

Gartner and IDC base their "PC market share" on the desktop, laptop and Intel servers shipped. So that excludes HP's big iron RISC servers and Apple's iPods, but includes all of each company's PC server sales. Revenue and profitability are based on the companies' actual finance reports, so it does include all the business they do.

CB: I don't understand your last chart [on comparison of market valuations] could you explain.

The left side chart shows how Apple (the green bar) compares to the other top PC makers; On the right is a comparison of Apple (again in green) against other tech companies.

Market capitalization is the number of shares in the company times the share price, the total value investors have put on the company. Market cap compares how the market values companies in relation to each other, and is based on profitability, future outlook for sales, and capacity for revenue growth.

JMS: Looking at your chart: "How Big Is Apple?" can you explain to me why pray is Cisco the #2 company ahead of both IBM and Intel?

Cisco is profitable. It made $5 billion on $28 billion in revenues last year, while Intel made $5 billion on $35 billion, and IBM made $9.5 billion on $91 billion in revenues. The market is saying that Cisco is doing a better job handling its money, and subsequently values it higher than companies with greater revenue, but less relative profitability.

Microsoft Strikes Back?

SH: In order to establish desktop dominance, Apple needs to wipe competition, but more importantly, needs a rich and viable market ecosystem (both software and hardware). With the "cream of the crop" logic, it's not possible to reach this. Furthermore, if Microsoft starts to realize what’s happening, they can rapidly overturn their problems (remember, they have a lot of $$$). At this point, the 6% - 9% of actual Mac market share is very fragile and the Mac is still in a vulnerable position.

As Apple begins to seriously threaten Microsoft, the company will no doubt devote more attention into competing with Apple. However, the problem for Microsoft is that it can't really compete with Apple.

For starters, it has no hardware to sell against Apple; introducing a Microsoft PC would do the same thing as the Zune did: cut into sales of Microsoft's licensee partners. Microsoft also lacks the capacity or expertise to sell hardware. The Xbox is a loss leader, and together with the Zune catastrophe, it lost over $1.2 billion just in 2006.

Since a hardware face-off with Apple is impossible, the only action Microsoft could take to compete with Apple would be to lower its prices for OEM copies of Windows--which are already low, around $30--in an attempt to get PC makers to lower PC hardware prices.

Microsoft can’t tell PC makers what to sell, or set their prices. Even if Microsoft made OEM licensing cheaper, PC makers could just pocket the difference. And, of course, there are many PCs that are already cheaper, but that fact has little impact on Mac sales.

Buyers of Macs are not price shopping; they are going out of their way to buy a premium product: better hardware, better security, fewer exploits, and a better user interface.

None of those factors are things Microsoft can compete with, so there's simply little Microsoft can do to take back Mac defectors apart from waging a negative FUD campaign against Apple as it did against Linux. What can Microsoft assail about Mac OS X: patent infringement? lower TCO? Nothing.

In reality, Apple's slowly expanding share of the market is the opposite of fragile: it's a solid base built upon non-price sensitive buyers. Had Apple won converts simply by undercutting PCs on price, it would risk losing those new customers to the next company to arrive with something cheaper. Apple is winning switchers based on compelling features, something that is very hard to compete against.

Establishing a Brand

Drivers interested in a BMW are not going to jump in a Buick just because of some incentive pricing; the Buick was already cheaper. What the Buick lacks is BMW appeal, something that no amount of money can whip together in a series of focus groups and power meetings.

Not even the four photos of Tiger Woods on the Buick home page make the cars distinguishable from, say, Oldsmobile, a brand that no longer even exists. Similarly, the amusing deadpan antics of Ellen DeGeneres didn’t help make the Zune exciting.

It takes many years to establish a brand. Microsoft’s branding is based largely upon erasing the past and introducing a new set of brands every couple years, not on building a reputation for quality. The company only has two main brands: Office and Windows. Everything else has rapidly changed names.

For example, in the early 90s, QuickTime competed against Video for Windows, then Active Movie, then Direct Movie, then Windows Media. Apple still calls it QuickTime, over 15 years later.

Microsoft has to change names to escape the reality of its products; Windows is associated with spyware, bloat, installation complexity, and security problems. One of the worst Windows-branded products is WinCE, which is now being re-marketed under the new name Windows Mobile.

Speak of the Devil

RCB: I have my doubts about [Apple trouncing WinCE]. I think WinCE will wind up like Windows in your scenarios - powering the low-end. Currently I see Verizon advertising $99 for a Motorloa Q smartphone. Yes, that's subsidized, etc. But what is the Q's full retail price? Is that a market Apple wants to compete in? Or are the going for the cream with the iPhone?

Despite the scoffin

Despite the scoffin g--and inaccurate--remark by Steve Ballmer that it was the “most expensive phone in the world, ” the iPhone is priced like the iPod.

g--and inaccurate--remark by Steve Ballmer that it was the “most expensive phone in the world, ” the iPhone is priced like the iPod. The iPhone is a handheld PC with phone and iPod functions, priced at $500, comparable to other high end phones with fewer and simpler features.

Ballmer knows that high-end Windows Mobile phones are actually more expensive than the iPhone, and offer less; his bringing up the Motorola Q was a desperate bit of FUD.

The Motorola Q is a ~$300 phone that feels like it's worth $50, and is sold under special promotion as being $99 so it can compete for attention with all the “feature phones” that are free. It is still tanking.

What is it about WinCE makes Windows Mobile phones cheap? Why not use Linux or existing embedded systems in low end mobiles? What does Microsoft offer manufacturers? Nothing really.

Microsoft's software is a middleman business; in PCs, it saved vendors from having to write their own OS, but Microsoft has little business potential in other areas, from PDAs to phones to music players, because there are existing embedded systems that work far better and don't require Microsoft's expensive licensing. That's why WinCE based products are all huge failures mounting huge losses.

Like reading RoughlyDrafted? Share articles with your friends, link from your blog, and subscribe to my podcast!

Did I miss any details?

Next Articles:

This Series

|

|

|

|

Del.icio.us |

Del.icio.us |

Technorati |

About RDM |

Forum : Feed |

Technorati |

About RDM |

Forum : Feed |

Monday, March 5, 2007

Send Link

Send Link Reddit

Reddit Slashdot

Slashdot NewsTrust

NewsTrust